maryland student loan tax credit 2020

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were awarded anything. It is critical that we look for ways to help those in our state crippled by student loan debt Governor Hogan.

Learn How The Student Loan Interest Deduction Works

To be considered for the tax credit applicants must.

. MHEC Student Loan Debt Relief Tax Credit Program 2019. As with other forms of employer-provided educational assistance previously included in the law the amount of the payments is capped at 5250 per year per employee and is excluded. 6 North Liberty Street.

To be eligible for the tax credit Maryland residents must have incurred at least 20000 in student loan debt and have at least 5000. Student Loan Debt. Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and.

Hogan announces 9M in tax credits for student loan debt By. Governor Hogan Announces 2019 Award of 9 Million in Tax Credits for Student Loan Debt. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a.

The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes. 410 767-3300 or 800 974-0203. Larry Hogan spoke at the Annapolis Summit Wednesday Jan.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor. The Student Loan Debt Relief Tax Credit Program Who How and When to Apply. A copy of the required certification from the Maryland Higher Education Commission must be included with Form 502CR.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in student loan debt undergraduate or graduate and Currently owe at least a 5000 outstanding student loan debt balance. For more information contact. If the credit is more than the taxes you would otherwise owe you will receive a tax refund for the difference.

All Maryland taxpayers who maintain Maryland residency for the past tax year may apply by completing the Student Loan Debt Relief Tax Credit application from July 1 through September 15 each year. Increasing from 5000 to 100000 the amount of the Student Loan Debt Relief Tax Credit that certain individuals with a certain amount of student loan debt may claim against the State income tax. 9282020 14154 PM.

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return. The new stimulus bill signed on December 21 2020 extends the ability for employers to make tax-free student loan repayment contributions for employees until 2025. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

Student Loan Debt Relief Tax Credit for Tax Year 2020. Student Loan Debt Relief Tax Credit for Tax Year 2020. From July 1 2022 through September 15 2022.

Associated Press January 13 2020 Gov. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr. It is critical that we look for ways to help.

An official website of the State of Maryland. Fielder announced the awarding of nearly 9 million in tax credits for 9600 Maryland residents with student loan debt. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes.

Complete the Student Loan Debt Relief Tax Credit application. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are making eligible undergraduate andor graduate education loan payments on loans obtained to earn an undergraduate andor graduate. The sum of all Endow Maryland tax credits.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education Commission MHEC Secretary Dr. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

If the credit is more than the taxes owed they will receive a tax refund for the difference. Were eligible for in-state tuition. Increasing from 9000000 to 100000000 the total amount of tax credits that the Maryland Higher Education Commission may approve in a taxable year.

Student Loan Debt Relief Tax Credit Program. Fielder announced the awarding of nearly 9 million in tax credits for 9600 Maryland residents with student loan debt. If the credit is more than the taxes owed they will receive a tax refund for the difference.

I didnt receive anything in the mail in December about it like I did last year although everything through USPS is delayed right now. Maryland Higher Education Commission. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get. 8 2020 hours before the Maryland. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get.

And applying the Act to taxable. For example if you owe 800 in taxes without the credit and then claim a 1000 Student Loan Debt Relief Tax Credit you will.

Student Loan Debt Statistics In 2021 A Record 1 7 Trillion

What Are The Pros And Cons Of Student Loan Forgiveness

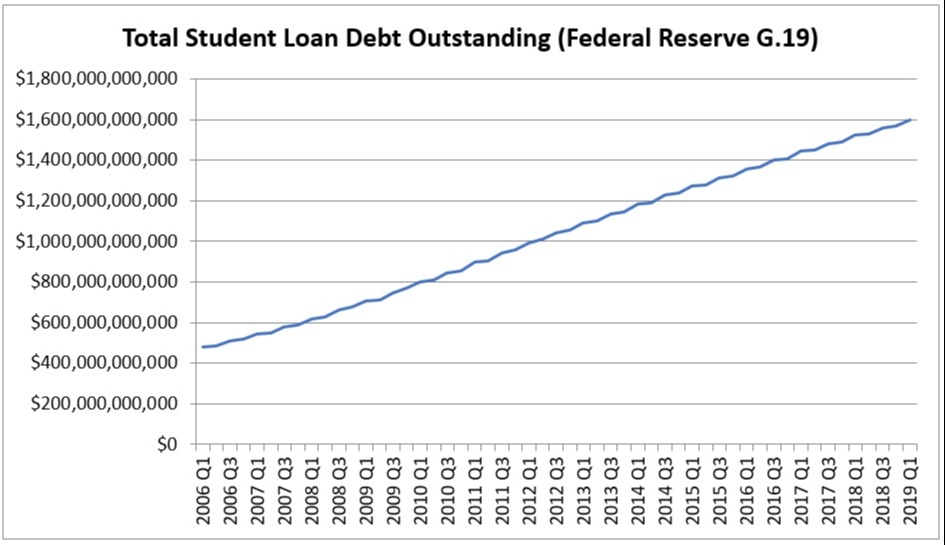

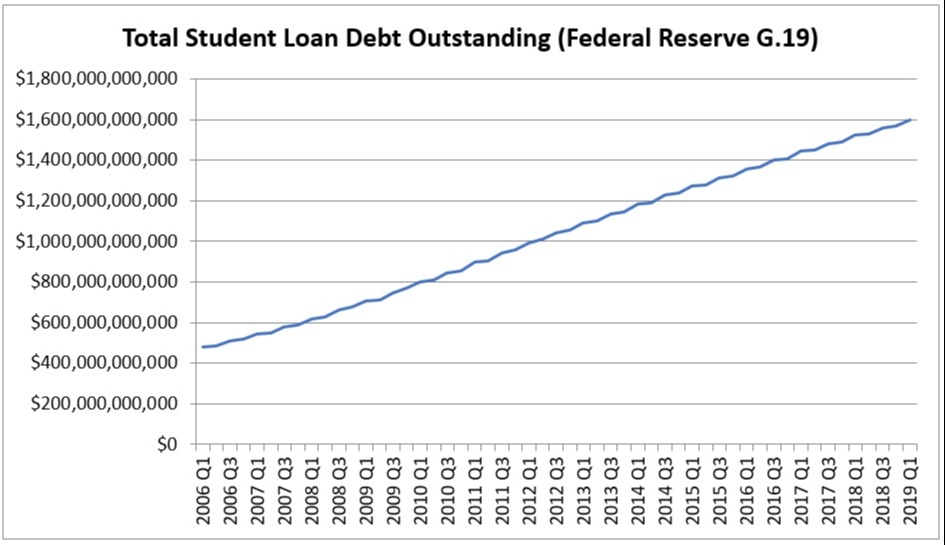

Total Us Student Loan Debt Outstanding Saving For College Blog

What Are The Pros And Cons Of Student Loan Forgiveness

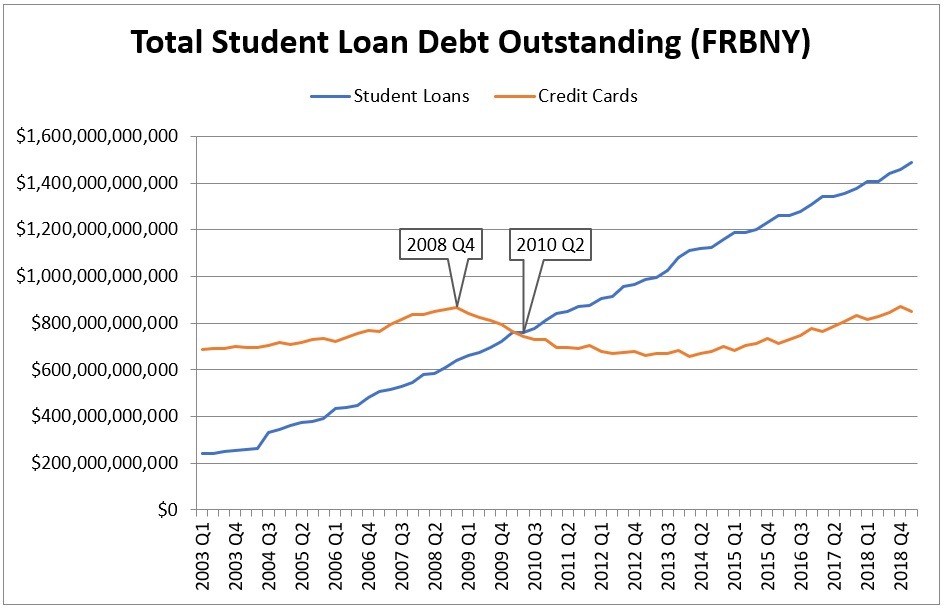

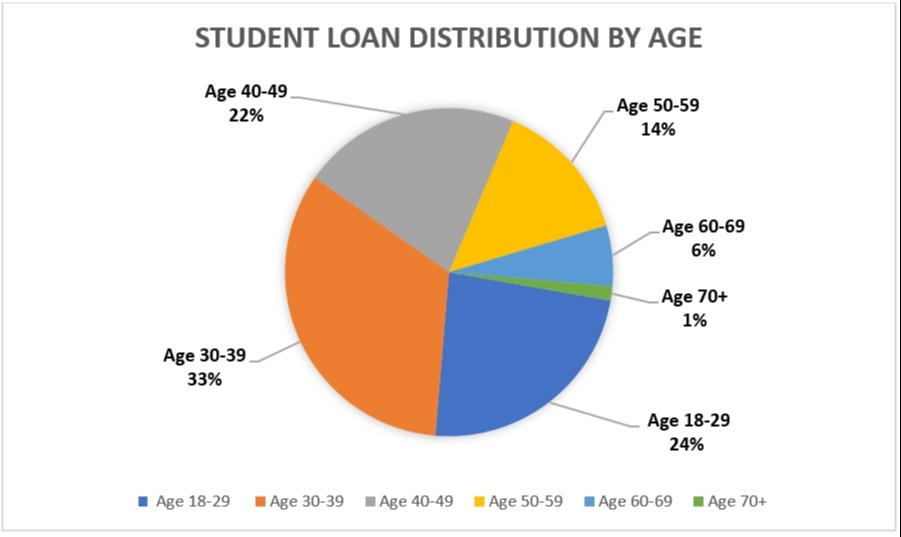

Student Loan Repayment Statistics

Can I Get A Student Loan Tax Deduction The Turbotax Blog

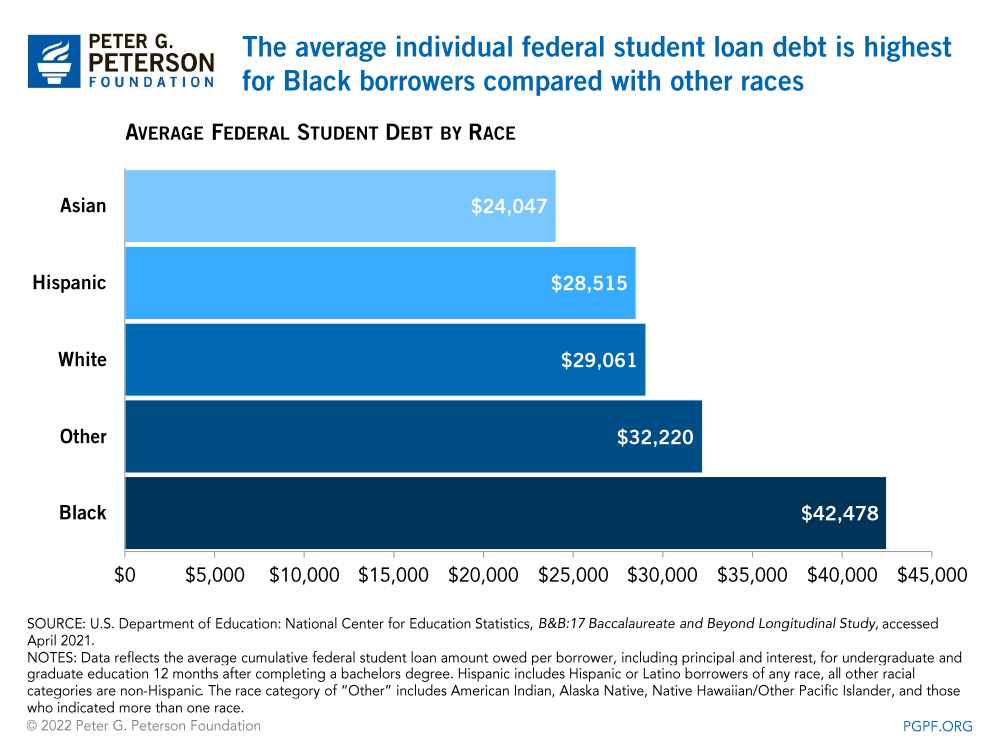

Statistics Concerning Student Loan And Borrower Characteristics

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Learn How The Student Loan Interest Deduction Works

What Are The Pros And Cons Of Student Loan Forgiveness

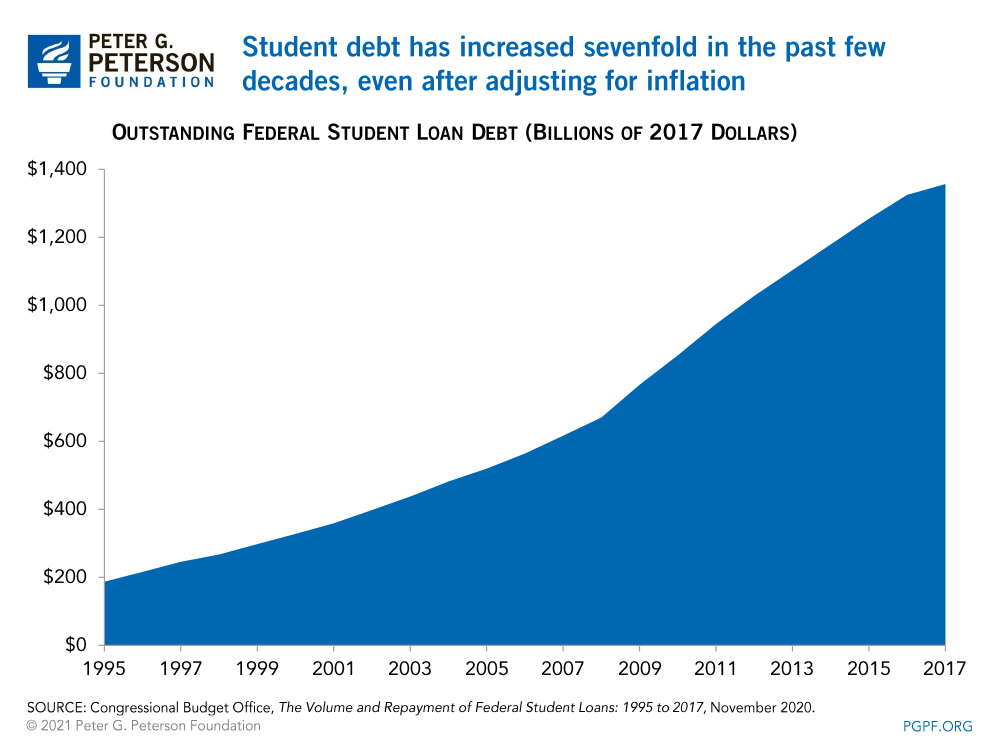

Student Debt Has Increased Sevenfold Over The Last Couple Decades Here S Why

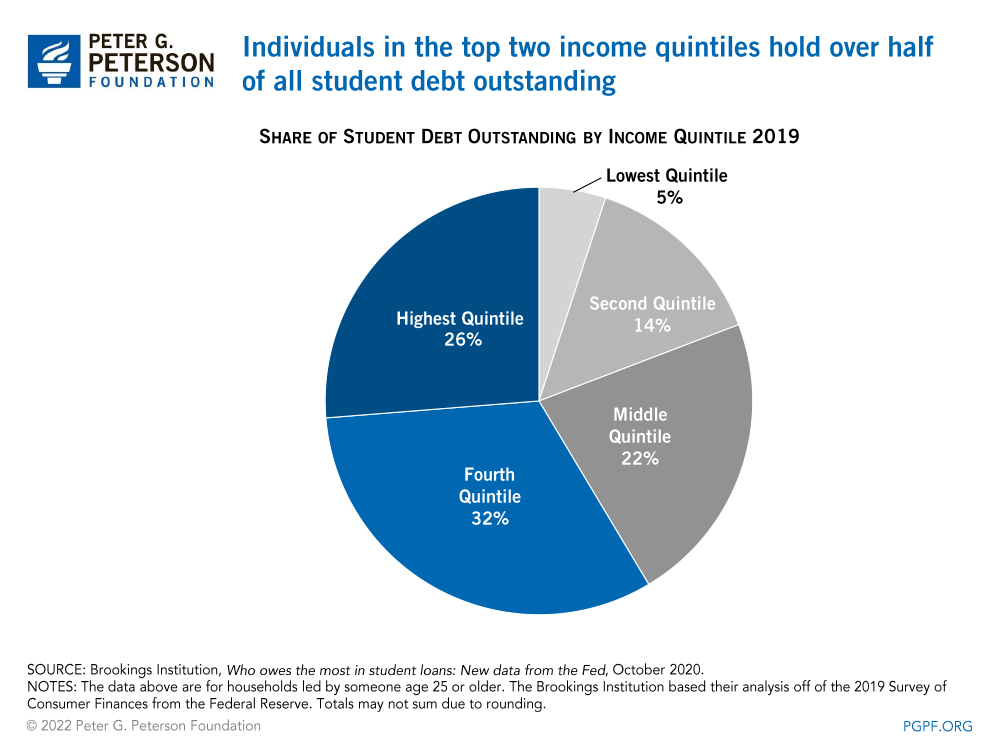

Who Owes The Most Student Loan Debt

Student Loan Forgiveness Statistics 2022 Pslf Data

Total Us Student Loan Debt Outstanding Saving For College Blog

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero